Market briefing – The investor emotional cycle – 27th April 2020

It is inevitable that the global economy is heading for a recession. How deep it is and how quickly recovery occurs will depend on the time taken for life to return to some semblance of normality; whatever ‘normal’ is at that time. There will not be a specific day when normality returns either; the process will be staggered and distinctive for different aspects of society, including the economy.

Certain sectors of the economy, and by extension the markets, will react at different times and what we once considered normal, may be different going forward. Although a successful vaccine is unlikely to occur anytime soon, the creation of one would see a faster return to normal life in all aspects, including the economy and markets.(1)

The potential cost of emotional investing

Warren Buffett once said that as an investor, it is wise to be “fearful when others are greedy and greedy when others are fearful.”

On the surface, that statement appears to be quite contrary. However, seeing as he is considered as one of the most successful investors of all time, it is worth considering what he could mean.

Psychological studies have investigated the connection between feelings and judgments. For example, when things are going well, it feels that nothing can go wrong. And when things go badly, we often take drastic action. Emotions can be an enormous threat to an investor’s financial situation, so it’s essential to be aware of them. Being aware of these can help investors in broadly knowing when to make good – and bad – investment decisions. In other words, helping to mitigate the risks and maximising the opportunities.

Investor emotional cycle

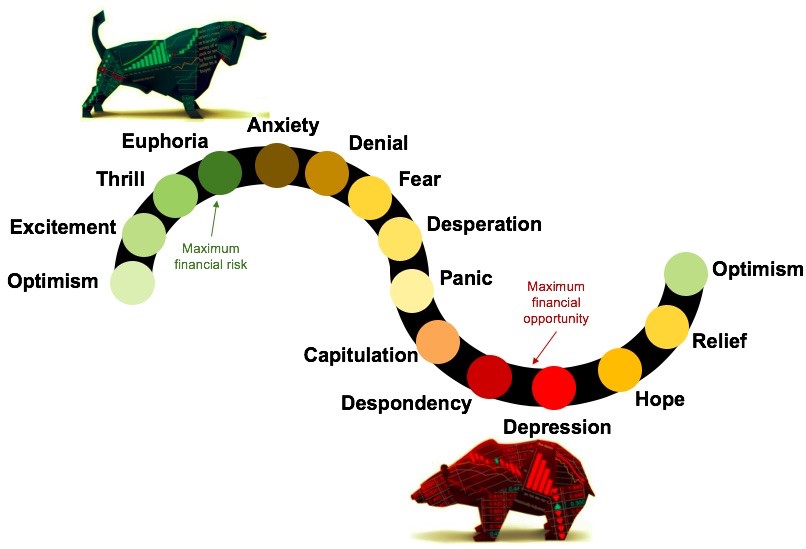

Investors get excited when their investments are performing well; and are disappointed when they are not. In general, investors’ emotional responses change depending on the conditions of the stock markets. This can generate a wave of emotions that results in what is called the ‘investor emotional cycle’. This is composed of different emotional stages that go together with the rise and fall of their investments. The chart below (2) illustrates the different emotional states typically experienced by the majority of investors:

“The more emotional the event is the less sensible people are.”

Dr Daniel Kahneman, 2002 Nobel Prize Winner for Economics

Optimism to euphoria

Everything starts with a positive outlook towards the future that leads to an initial investment (optimism). Markets start moving up towards an investor’s expectation and a feeling of anticipation rises as they start to see investment success (excitement). Markets continue to go up, and as the investor is already seeing good returns, they start to feel very confident (thrill). They start thinking that ‘the only way is up’ and everything they see is an investment opportunity. It feels like everyone wants to jump in as the market cannot go down; can it? It’s at this point, that the financial risk is at its maximum (euphoria).

Anxiety to depression

Things then start to turn around. Stock markets start showing the first signs of weakness. Investors tell themselves that the the long term is still bullish and convince themselves that it is just a short correction (anxiety). The market correction is now taking longer than originally thought. Doubts start and confidence in the long-term market turns into a strong hope for a short-term improvement (denial). At some point investors have to compare their perception with the reality. Investors start thinking they’d like to get out taking a small profit – even a small loss – but they don’t act because they don’t know what to do (fear).

Things then start to turn around. Stock markets start showing the first signs of weakness. Investors tell themselves that the the long term is still bullish and convince themselves that it is just a short correction (anxiety). The market correction is now taking longer than originally thought. Doubts start and confidence in the long-term market turns into a strong hope for a short-term improvement (denial). At some point investors have to compare their perception with the reality. Investors start thinking they’d like to get out taking a small profit – even a small loss – but they don’t act because they don’t know what to do (fear).

All chances of making a gain have now gone. Investors are now concerned about their investment and strongly hope for anything that will bring their holdings back (desperation). This is the period with the most emotional impact, where they feel helpless and don’t know what to do (panic). They sell their investments at any price because they have reached their breaking point. They are happy to get out of the stock market in order to avoid bigger losses (capitulation).

Because of the large loss on their investment, their expectations have been shattered. They feel they do not want to invest ever again. For those investors who are aware of what is going on – and are willing to be contrarians – this is the point of maximum financial opportunity (despondency). Investors start thinking about what has happened. The key point at this part in the cycle is that informed investors start to look back to what has happened and analyse what has occurred, and, crucially learn from any mistakes (depression).

Hope to optimism

Things start to gradually improve. The overall situation gets better and investors realise that financial markets have cycles. They now have some experience and start to look around for new investment opportunities (hope). Markets are turning positive once again. Investors regain positivity and decide they should invest again (relief).

Things start to gradually improve. The overall situation gets better and investors realise that financial markets have cycles. They now have some experience and start to look around for new investment opportunities (hope). Markets are turning positive once again. Investors regain positivity and decide they should invest again (relief).

The cycle then starts all over again… i.e. Everything starts with a positive outlook towards the future that leads to an investment (optimism)…

What are the consequences

As can be seen from the above, extreme emotions turn logical investors in to irrational people. Especially during these difficult times, it is essential to remember that markets move up and down over time and investments have a cycle. If you haven’t already identified where you are emotionally on the above cycle, re-read the above and try and honestly appraise where you might be.

Not acknowledging that we are human, and are susceptible to the above cycle, can lead to well thought out diversified long-term financial plans being placed in jeopardy when investors are confronted by extraordinary events. As far as possible, decisions should not be guided by emotions. This is where the role of the financial adviser is of utmost importance. Your adviser can help you separate your emotions from reality and endeavour to keep you on the path of rational investing.

Continue to keep calm

It is true that the short-term horizon is extremely uncertain due to the unpredictability of this situation. However, it is important to remember that we very often have a long-term investment time horizon.

We will continue to monitor the current financial situation and keep you notified of any changes that are made. Please seek professional financial advice if you wish to discuss your financial situation further.

Sources

(1) Square Mile Investment Services Limited

(2) Illustration based on the Cycle of Market Emotions chart created by Westcore Funds/Denver Investment Advisors LLC, US which draws inspiration from the Kubler Ross change curve

This publication is marketing material. It is for information purposes only. This statement is for the sole use of the recipient to whom it has been directly delivered by their Foster Denovo Partner and should not be reproduced, copied or made available to others. The information presented herein is for illustrative purposes only and does not provide sufficient information on which to make an informed investment decision. This document is not intended and should not be construed as an offer, solicitation or recommendation to buy or sell any specific investments or participate in any investment (or other) strategy. Potential investors will have sought advice concerning the suitability of any investment from their Foster Denovo Partner. Potential investors should be aware that past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and they may not receive back the amount they originally invested. The tax treatment of investments depends on each investor’s individual circumstances and is subject to changes in tax legislation.

0330 332 7866

0330 332 7866 advise-me@fosterdenovo.com

advise-me@fosterdenovo.com Search

Search