Inflation, interest rates, and your investments in 2026: A guide

9.02.2026Predictions about the economy are notoriously hard to get right. Global conflicts, unpredictable world leaders, and even the weather can all impact share prices, investor confidence, and wider markets.

However, for respected forecasters and finance professionals, emerging trends can make predictions possible. For example, UK interest and inflation rates are inherently linked, allowing experts to project trends for the rest of the year and into 2026. This allows us to think about the potential implications for your investments.

Keep reading to discover what you can expect from the UK economy in 2026 and what the projected changes might mean for your money and long-term plans.

The UK economy now, and looking ahead to 2026

Inflation

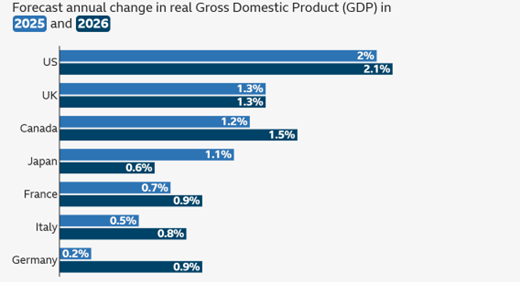

Recent forecasts from the International Monetary Fund (IMF) – as reported by Bloomberg – suggest that the UK could end 2025 as the second-fastest-growing economy in the G7. With a predicted 1.3% increase in GDP for the year, the UK is second only to the US.

Source: BBC (data from the IMF)

After a trying year of geopolitical tensions and uncertainty (not least in the form of war in Ukraine and the Middle East, and White House tariffs), these figures will be gratefully received by chancellor Rachel Reeves. However, there is bad news too.

The IMF expects the UK to have the highest inflation of all G7 nations in 2025 and 2026.

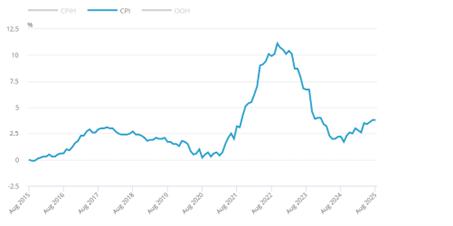

Since its 41-year high of 11.1% back in October 2022, the Consumer Prices Index (CPI) has been broadly falling. More recently, however, rising energy and food prices have kept inflation persistent, pushing the CPI up again.

Source: ONS

The bond giant Pimco and the Bank of England (BoE) both expect inflation to continue rising in the short term, before dropping closer to the BoE’s target of 2% in 2026.

Interestingly, when speaking to the Financial Times on the subject of inflation, Andrew Balls, Pimco’s chief investment officer for global fixed income, confirmed, “We don’t think the UK economy will prove to be a massive outlier.”

He added that the UK’s high prices were, globally speaking, “nothing that special”.

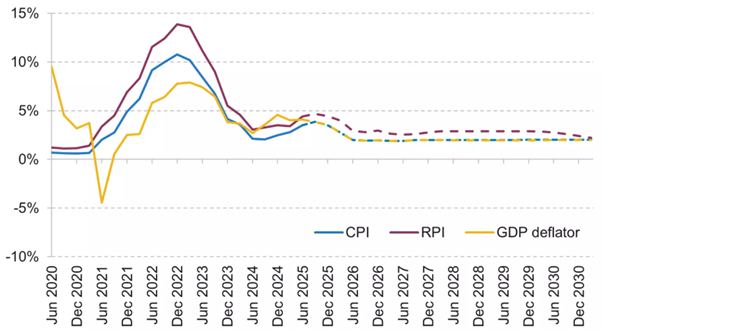

Source: Institute for Fiscal Studies (IFS) (ONS, Barclays research)

Meanwhile, the BoE’s Monetary Policy Committee (MPC) and the IFS agree. Speaking after its latest base rate decision, the MPC confirmed that it expects the CPI to rise again in September before falling to 2% in the “medium term”.

Interest rates

Of course, inflation and the BoE base rate are inherently linked. Interest rate rises make borrowing more expensive and saving more attractive, dissuading consumers from spending. The hope is that this will ultimately lead to a drop in prices; the opposite occurs during periods of low inflation.

Pimco expects falling inflation to reach the BoE’s 2% target by the end of 2026. This would allow for further base rate cuts, down to the so-called “neutral rate” of 2.75%. However, much will rest on the reaction to Rachel Reeves’ second budget.

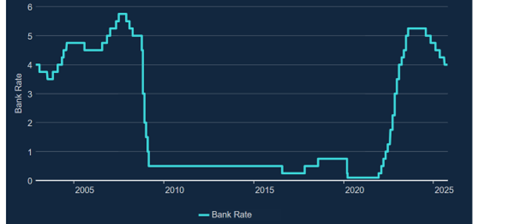

Source: BoE

The base rate had already been low for a decade – spelling bad news for savers – when the Covid pandemic arrived. This led to a historic low, followed by 14 consecutive rises, from 0.1% in October 2021 to 5.25% by August 2023.

With the base rate currently set at 4%, some experts predict a further fall of just 0.5% between now and the end of 2026. This would put the UK central bank at odds with its peers. The European Central Bank policy rate, for example, is currently 2%, while the US Federal Reserve may cut its rate by at least 1% in 2026.

The impact of interest rates and inflation on your investments

Changes to inflation and interest rates, as well as the global economy, can all impact your investments. Recent volatility in bond markets and changes in interest rates affecting mortgages and the property sector make the outlook for 2026 unpredictable.

While fixed income bonds remain an important part of any portfolio – whether to generate income or protect against inflation – simultaneous downturns in bonds and equities might necessitate a review of diversification and hedging strategies. The performance of inflation-linked securities, too, is hard to predict, but based on assumptions from leading forecasters, the outlook would be best described as “mixed”.

Real assets, meanwhile, are expected to benefit from stabilising UK growth – notwithstanding fallout from the imminent Budget. Colliers projects all property capital values to rise 2.6% in 2025, followed by 4.2% in 2026.

Overall, the message remains the same as ever. Beware of an over-reliance on cash amid rising inflation and the opportunity cost associated with failing to invest. Global uncertainty means that market volatility is likely to continue, so diversification – across asset classes, sectors, and particularly geographic regions – remains key.

As a high net worth individual, you may well hold alternative assets such as hedge funds or Venture Capital Trusts (VCTs). The already high-risk nature of these investment types, combined with a volatile market and unstable geopolitical landscape, means that a hybrid approach, combining traditional and alternative assets could prove a beneficial strategy as we head into 2026.

If you have any questions or concerns about the economy now, or into 2026, please reach out to your Foster Denovo adviser by emailing advise-me@fosterdonovo.com or calling 0330 332 7866 for more information.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up, and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

https://www.bbc.co.uk/news/articles/cn092p27xn0o

https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/august2025

https://ifs.org.uk/publications/economic-outlook-navigating-narrow-paths

https://www.bankofengland.co.uk/monetary-policy/the-interest-rate-bank-rate

Search

Search