Foster Denovo is committed to fostering an inclusive and equitable workplace where all employees are valued and have the opportunity to thrive. In compliance with the UK’s gender pay gap reporting requirements, we are publishing our gender pay gap data.

The gender pay gap is the difference in average earnings between men and women across our workforce, regardless of role, seniority or function. This is distinct from equal pay, which ensures men and women are paid the same for equivalent work. Our report focuses on the median gender pay gap, as it provides a more representative view of typical pay by minimising the impact of unusually high or low earners.

Key findings

As of our first year of reporting, our median gender pay gap is 31%.

- Mean gender pay gap: 28.79%

- Median gender pay gap: 31.09%

- Mean bonus gender pay gap: -21.76% (favouring women)

- Median bonus gender pay gap: 44.06% (favouring men)

- Proportion of employees receiving a bonus: 69% male, 72% female

Understanding the gap

Our current gender pay gap is primarily influenced by the lower representation of women in Financial Adviser roles. This can be attributed to:

- The financial services industry which has historically attracted a higher proportion of male applicants, although this is changing.

- There is a statistically lower turnover in Financial Adviser roles, resulting in less movement and slower change in the gender balance within these positions.

Our commitment to progress

Foster Denovo is dedicated to creating a more balanced and diverse workforce. We believe that diversity is a significant strength that enhances our culture and reflects the diversity of our clients. Our recent growth has enabled us to create new roles and attract top talent from all backgrounds. We are committed to the following initiatives:

- Women in Finance Charter: We signed the Women in Finance Charter in 2023, demonstrating our commitment to gender balance across the financial services sector.

- Senior Role Targets: We have exceeded our targets for female representation in senior roles. In 2023, we aimed for 40%, and in 2024, we achieved 46%, which is well above the industry standard of 20%.

- External Recognition: Our commitment to our staff was recognized in 2024 with the Platinum Investors in People Award, which reflects our dedication to employee development and workplace inclusion and diversity.

- Celebrating Women in Finance: We showcase the achievements of women in our business through a monthly blog series, “Women in Finance.”

- Inclusive Recruitment: Our talent acquisition team employs gender-neutral language in job adverts, proactively reaches out to diverse candidate pools, and monitors selection processes to remove potential barriers.

- Flexible Working: We promote flexible working arrangements to support employees with personal commitments, encouraging them to remain in or return to the workforce. We are also reviewing our benefits package and introducing flexible benefits, including enhanced maternity provisions.

- Learning and Development: We have further developed our learning and development programs, including succession planning and internal academies, to support the development of future female talent.

Data Tables

Pay Quartiles

| Quartile | Female | Male |

|---|---|---|

| Upper | 26.9% | 73.1% |

| Upper Middle | 47.4% | 52.6% |

| Lower Middle | 32.1% | 67.9% |

| Lower | 31.6% | 68.4% |

Bonus Pay Gap

| Metric | Female | Male | Gap |

|---|---|---|---|

| Mean Bonus Pay | £3,631.79 | £4,421.95 | -21.76% |

| Median Bonus Pay | £1,920.25 | £1,645.00 | 44.06% |

Declaration

I confirm that the data and information provided in this report are accurate and in line with the requirements of the UK’s gender pay gap reporting legislation.

Louise Blair

Director of People and Culture

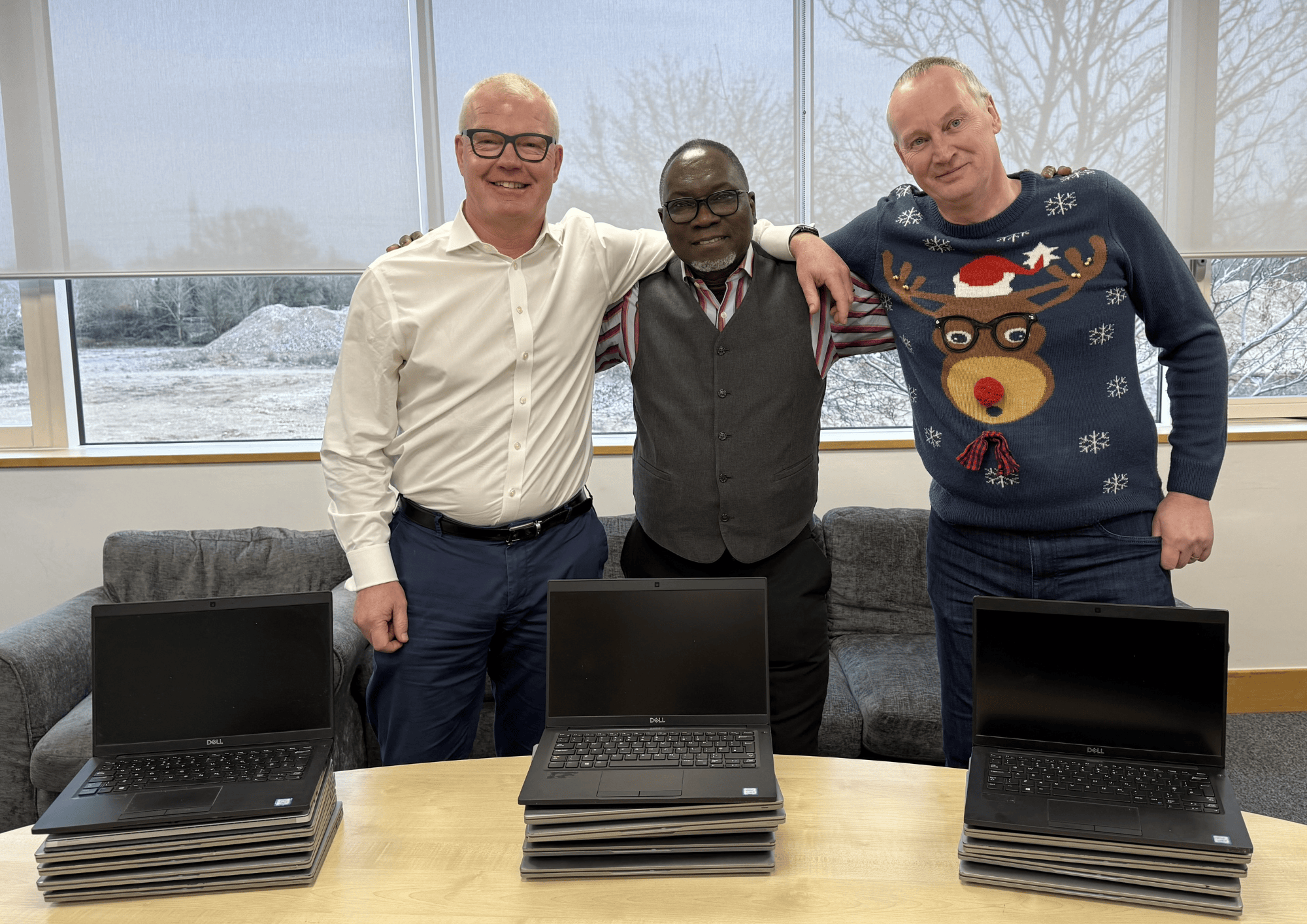

Open to everyone

As a workplace, we’re proud to showcase our commitment to supporting colleagues of all genders and backgrounds.

What our clients say

Harshit Mehta

“It was very easy to deal with our Partner at Foster Denovo during the entire remortgage process. They tried their best to get the remortgage completed in time and even helped escalate complaints we had with solicitors. I highly recommend Foster Denovo for financial and mortgage advice.”

James Hunt

“Feel very lucky to have the advice and expertise on offer, especially how much time was dedicated to our case. Having been supported through 3 applications and receiving excellent client service I would always recommend Foster Denovo.”

Alison Field, Group HR Director, Briggs Equipment

“We are always very busy and so I appreciate that we can fully outsource our pensions and benefits admin including Group Life Assurance, Group Income Protection and Private Medical Insurance to the Secondsight team. And I can’t speak highly enough of you and your team.”

John Tyszkiewicz

“Our Partner is a mortgage rock star.”

Thomas Edwards

“Process became difficult half way through so we had to sell a long time before buying the new property. Our Partners were fantastic from start to finish, kept me informed and chased all relevant parties immediately when needed. Literally faultless from my perspective.”

Sophie Whiteway

“Our Mortgage Partner was great- they touched base frequently without being overbearing during our house hunt. We waited a long time from offer acceptance to completion date and required a mortgage offer extension which was arranged without issue. My partner is self-employed so our Partner also ensured we had all the correct information and documents to gain mortgage approval. Would definitely recommend”

Ava Dennie

“The whole process from beginning to end was seamless. We were kept informed by our consultant at all times, no matter the time of day. There were areas of anxiety but our consultant dealt with it all and ensured all queries were dealt with as soon as possible. Would highly recommend.”

Karen Morris

“My Partner is extremely friendly and explains any questions I have. They fully and competently guided me through the process and I have full confidence in their knowledge and understanding.”

James Garner

“Our Partner is amazing, what a credit to any team . House would never have gone through without her. They went the extra mile every day”

Alexander Elliott

“Our Partner was fantastic, they made the whole application process stress free and was very adaptable to our quite specific requirements when finding us a mortgage that suited our needs.”

Amanda Standish

“A professional and personalised service. Worked tirelessly to find a mortgage suitable for my needs. Provided sound knowledge and advice and always following data protection procedures.”

“David has been very helpful in developing a strategy for us, with wills and trusts being the main component as well as investment ideas and life insurances. He has always been very patient and has taken the time to explain all the intricacies of these financial vehicles.

You can imagine the quantity of documents that we had to handle over the period. Tireless Kirsty was the one who handled them… She made a very complex process much simpler for us.”

Search

Search