Should I invest now?

17.10.2019It would be an understatement to say the UK political and economic environment has been unpredictable in recent months. Investment markets have been more volatile as a result of Brexit, as well as other global influences like the ongoing US-China trade war.

With so much uncertainty in the world, you might be nervous about investing. It’s not uncommon for people to consider putting off an investment or even withdrawing their portfolio, but these emotive decisions are likely to do more harm than good.

Let’s answer the big question; should you invest now?

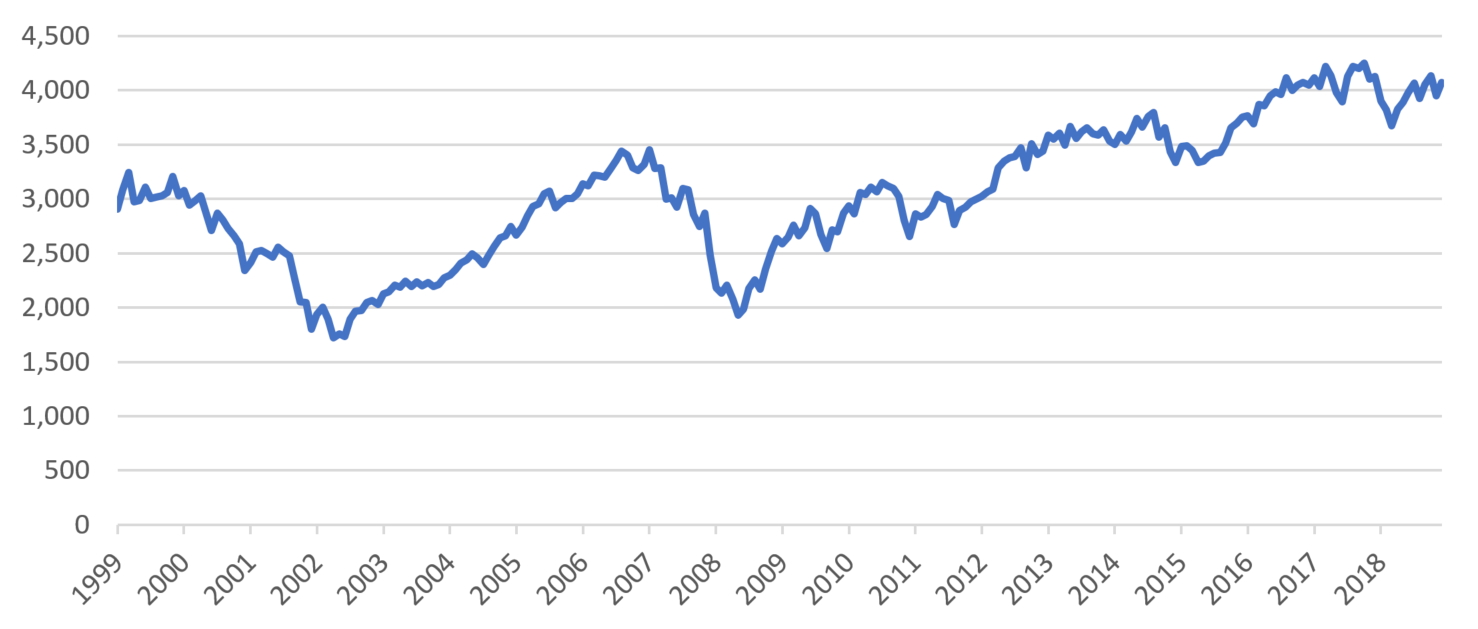

The graph below shows the 20-year performance of the FTSE-All Share Index, which is an aggregation of the FTSE 100, 250 and SmallCap indices. It represents the performance of around 600 businesses listed on the London Stock Exchange and is a good indication of the UK economy.

You can quite clearly see the effect of the 2008 financial downturn, but in the context of long-term investing, the market recovered remarkably quickly.

There will always be an external influence on market performance that you have little or no control over. Brexit is a current one, but over the past 20 years, growth in the markets has been consistent, even though major events have happened.

Think long-term

Warren Buffet famously said, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.” Investing is a long-term proposition; time in the market is more important than trying to time the market.

There is no ‘right’ time to invest, but we would always recommend investing for a minimum of five years. This gives you the time to weather volatility and improves your opportunity for growth. The problem is that a study by Schroders found that on average people only remain invested for 2.6 years before moving their money. It’s apparent that people are being tempted to make rash investment decisions, especially when volatility is involved.

Investing long-term isn’t just about weathering the negative days. Research from J.P.Morgan actually found that if you missed the best ten days in the market over the past 20 years, your investment return would be halved! That just goes to show that you can’t time your investment and having patience can ultimately pay off.

Keep calm and carry on

Markets in the last quarter of 2018 were especially volatile. The MSCI World Index (which is a broad global equity index that represents large and mid-cap equity performance across 23 countries) fell by almost 14%. During these months, Schroders found that 82% of investors altered their investment portfolio, with:

- 20% moving into cash;

- 35% taking more investment risk; and

- 36% moving into lower-risk investments.

Subsequently, over 50% of investors said they had not achieved the investment returns they wanted over five years. Many also blamed their own action or inaction as the main cause of failure. So, at least with hindsight, investors acknowledge that making short-term emotive decisions can have a detrimental impact on their long-term financial security.

Those that moved into cash may have made the biggest mistake, as they will have effectively locked in a loss and their investment has no opportunity to recover. Panic selling would have been an especially poor decision during this time, as the market rebounded quite significantly in the first quarter of 2019.

Another quote from Mr Buffet explains that; “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate.”

Try not to get distracted by scaremongering. The media doesn’t help in these circumstances, especially when words like ‘crisis’ or ‘crash’ are thrown around without repercussions for the journalist. Markets are cyclical and short-term volatility should not influence your long-term strategy. Making snap decisions can have a more negative impact than doing nothing at all. If you have a robust financial plan, stick to it.

Talk to your financial planner

If you’re concerned about the financial impact of Brexit on your portfolio, don’t hesitate to get in touch. Ignore the noise, keep calm and carry on.

Should you invest now? The answer shouldn’t depend on external market influences such as Brexit. It should depend entirely on your personal circumstances, long-term goals and aspirations.

The value of your investment can go down as well as up and you may not get back the full amount invested.

This article was produced by our Private Wealth team.

Search

Search