Market Briefing 56 – 12th December 2023

14.12.2023Many investors will have known of Warren Buffett as being one of the most successful investors in history. However, Warren wasn’t the only one.

Charlie Munger was Buffett’s longstanding business partner who recently died aged 99. Munger, who was seven years older than Buffett, was a lawyer by training and helped Buffett develop a philosophy of investing in companies for the long term.

He was also famous for a quote which he partially attributed his success and longevity to: ‘Avoid crazy at all costs.

He was most prominently known as the Vice Chairman of Berkshire Hathaway, the multinational conglomerate led by Buffett. His insights on finance, investing, and life in general earned him a reputation as a revered figure in the world of business and finance.

His legacy will include his approach to investing, which emphasised the long-term view, value investing, and the importance of understanding businesses deeply before investing. His emphasis was on patience, rationality, and avoiding unnecessary risk.

He also advocated using mental models from various disciplines to make better decisions. He believed in the power of understanding multiple fields to gain insights into complex problems and make more informed choices.

Along with his wife, he was involved in various philanthropic endeavours. His contributions to education, particularly in the field of neuroscience and cognitive psychology, have had a lasting impact.

Overall, Munger’s legacy will revolve around his exceptional investing acumen, his emphasis on lifelong learning and multidisciplinary thinking, and his philanthropic efforts that aimed to make a positive impact on society.

He is often associated with the phrase, ‘The Art of Doing Nothing’, reflecting his approach to investing, which emphasised patience, discipline, and avoiding unnecessary action in the face of market fluctuations or pressures. Munger advocated for making informed, well-thought-out decisions and then being patient enough to let those decisions play out over time.

‘There are huge mathematical advantages to doing nothing.’

This concept involves not being swayed by short-term market movements or noise, and instead, focusing on understanding a business thoroughly, investing wisely, and having the patience to let the investments grow without constantly reacting to every market fluctuation.

‘The big money is not in the buying and selling, but in the waiting.’

Munger’s ‘doing nothing’ doesn’t mean inactivity or complacency; rather, it suggests avoiding impulsive or unnecessary actions driven by short-term market movements and emotions. It’s about having the confidence in well-researched decisions and the patience to let them unfold and yield results over the long term.

Much like Buffett, Munger has been critical of active managers, especially those who charge high fees for their services, describing some as ‘fortune tellers’. He often criticised the high fees charged by many active managers while highlighting the difficulty they face in consistently outperforming the market after accounting for these fees.

Munger’s perspective was that the average investor would likely benefit more from lower-cost index funds rather than paying high fees to active managers who may not consistently deliver better returns. Munger also acknowledged – as does Buffett – that there are active managers who have been successful over time and he respected managers and investors who possessed unique insights, discipline, and a long-term approach.

Charlie Munger clearly had strong views of many things including active management and passive – index – investing. So how should investors feel about this debate? Is it a simple choice that one is superior to the other, or is it more nuanced than that? What does the evidence show?

Active or index? And is it the correct question?

One of the main reasons given for investing in index funds, where the sole aim is to track as closely as possible a predetermined equity or bond index, is that an investor can achieve similar performance as they would get from actively managed funds without having to pay the inevitable higher management fees.

This debate – which has had experts like Charlie Munger provide commentary on – will continue for as long as there are stock markets and so it is not our intention to end the debate here. Analysing the different investment styles of active management and index investing however can help investors in coming to an informed view.

As the Financial Conduct Authority (FCA) reminds us, ‘past performance is not a reliable indicator to future results’, but using the past can still help in drawing some conclusions.

When constructing an investment portfolio, how different markets behave – whether these are geographically different (e.g., US or UK) or philosophically different (e.g., growth or value) – may help in achieving greater returns.

Let’s consider two different geographical and philosophical areas, i.e., the very large cap, growth orientated, equity market that is the North American sector, and on the other extreme, the relatively small cap, value orientated, equity market that is the UK Smaller Companies sector.

Contrasting these two extremes we may be able to draw some investment principles.

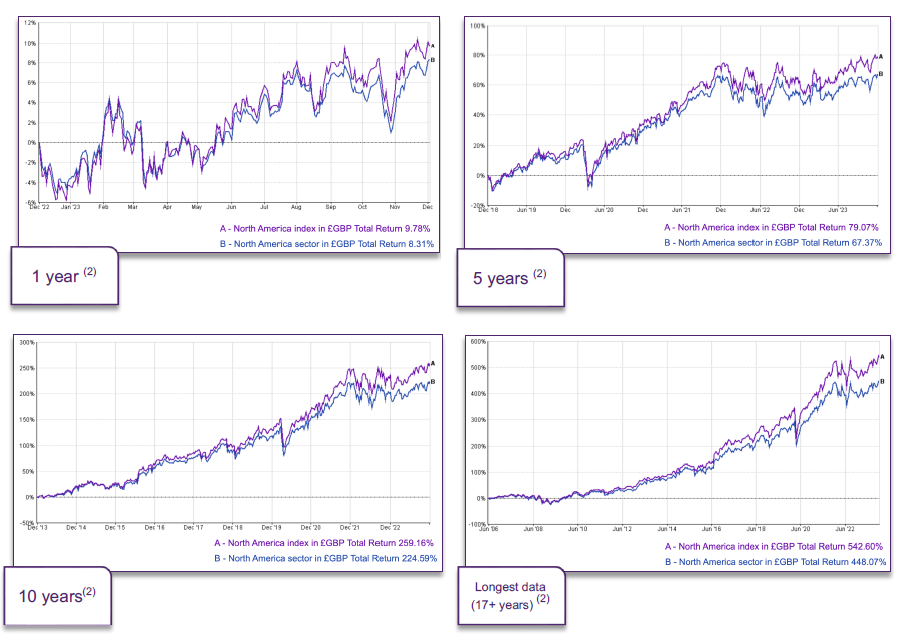

Viewing the very large equity market that is the North American sector – which measures the success of broadly active management in this sector – against an index tracker also focused on North America (in Sterling and net of fees for both active and index investing), we may be able to draw out some investment observations and potentially some principles.

In all the four timeframes shown, the index fund, tracking the North America growth equity index, outperformed the actively managed sector, as represented by the North America sector. This perhaps evidences that in such an efficient(3), widely researched and well-known market, active management outperformance over an index tracker is extremely difficult to achieve.

Also of note, and consistent with Charlie Munger’s comments above, in particular that ‘the big money is not in the buying and selling, but in the waiting,’ showing that in all timeframes without exception, patience is key and ‘doing nothing’ is a paramount discipline.

So, the conclusion from the above is that there is no point in active management and that all investing should be done using index funds.

Is that true? Let’s consider an alternative.

What should this tell you?

Research over many years, including the above, has shown that the ‘where’ and ‘in what’ funds are invested in can be favourable towards either index investing or active management. As shown above, investment sectors that would be considered to be more established and efficient – for example North America – sees active management struggling to outperform its index equivalent. This is because it is far more difficult for active managers to identify new investment opportunities, and pricing anomalies in those type of sectors, in this case an established geographical region.

In less-established investment sectors – for example UK smaller companies – which are generally considered to be relatively inefficient – the lack of complete data and knowledgeable analysts means, as evidenced above, that good active managers can more readily identify investment growth opportunities, often outperforming the related index.

In addition to this, the challenge over much of the last four decades or so has been finding active fund managers who consistently beat their benchmark and deliver constant growth, through selecting individual stocks. Therefore, more and more experts now believe that the real choice is not which of the two investment styles to go for, but rather how much of index investing and active management should be blended to suit an investor’s circumstances.

Remembering that ‘past performance is not a reliable indicator to future results’, from an investment perspective, investors should have a balanced view towards investing styles and philosophies. Investors’ focus should be on ‘smart diversification’. This should include investing across different asset types, such as bonds as well as equities, and across geographical jurisdictions, so they are not confined to one or two countries or regions. It should also involve investing across investment styles, that should include active management and index investing, and across different investment philosophies that includes growth and value.

Although ‘smart diversification’ doesn’t guarantee performance in any way and does not eliminate risk completely, having a diversified portfolio across asset types, geographical jurisdictions, sectors, investment styles and philosophies can help investors minimise their risks.

It is also important to remember that it is often the case that investors have a long-term investment time horizon. So, although ‘smart diversification’ does not guarantee against loss, it will likely help with the most important component of reaching long-range financial goals whilst minimising risk.

As we have said many times before, we will continue to monitor the current financial situation and keep you notified of any significant changes that are made. Please contact your Foster Denovo Partner if you wish to discuss your financial situation further.

Sources

1) https://www.handbook.fca.org.uk/handbook/COBS/4/5A.html

2) FE Fundinfo

3) Efficient market – Market efficiency refers to the degree to which market prices reflect all available, relevant information. If markets are efficient, then all information is already incorporated into prices, and so there is no way to ‘beat’ the market because there are no undervalued or overvalued securities available – https://www.investopedia.com/terms/m/marketefficiency.asp

4) Inefficient market – An inefficient market is one that does not succeed in incorporating all available information into a true reflection of an asset’s fair price. Market inefficiencies exist due to information asymmetries, transaction costs, market psychology, and human emotion, among other reasons. As a result, some assets may be over- or under-valued in the market, creating opportunities for excess profits – https://www.investopedia.com/terms/i/inefficientmarket.asp

5) https://www.onthisday.com

Search

Search