Market Briefing (no.54) 21st July 2023

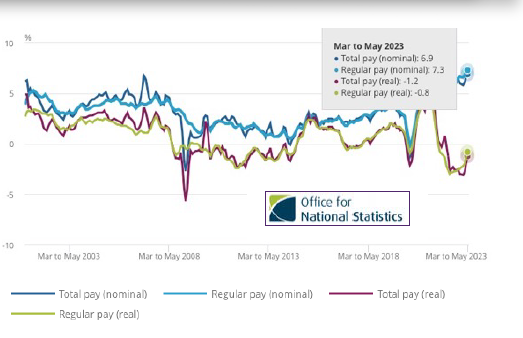

The latest labour market data for the UK from the Office for National Statistics (ONS) (1), shows that average total pay, including bonuses, rose by 6.9% in March to May 2023 when compared with the same period in 2022. Regular pay, which excludes bonuses, rose by 7.3%.

Real terms total pay – which is pay adjusted for the impact of inflation – unsurprisingly fell by 1.2%, with regular pay dropping by 0.8% over the same period.

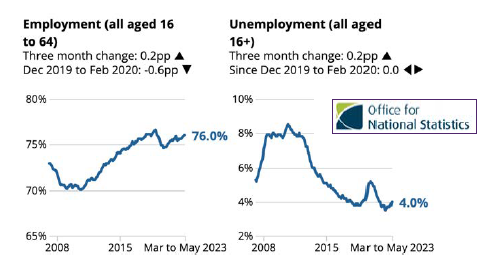

UK unemployment increased by 0.2% to 4.0%, with job vacancies continuing to fall in the period April to June by 85,000 to just over 1million.

On the other hand, the UK employment rate rose again by 0.2% to 76.0% in the period March to May 2023, an increase driven mainly by part-time employees.

The Bank of England has confirmed that the results of the 2022/23 annual cyclical scenario stress test show that major UK banks are resilient to severe stress scenarios. (2)

These scenarios include persistently higher advanced inflation, increasing global interest rates, deep simultaneous recessions with materially higher unemployment in the UK and global economies, and sharp falls in asset prices.

The results of the stress test support the Bank of England’s judgement that the UK banking system has the capacity to support households and businesses through a period of higher interest

rates, even if economic conditions are substantially worse than expected.

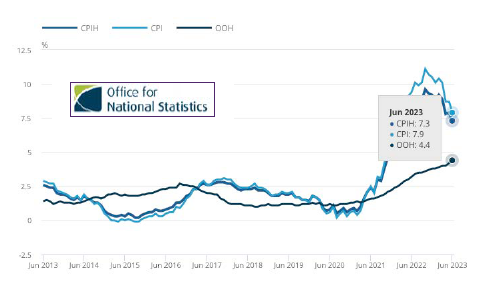

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 7.3% in the 12 months to June 2023, down from 7.9% in May. On a monthly basis, CPIH rose by 0.2% in June 2023, compared with a rise of 0.7% in June 2022. The Consumer Prices Index (CPI) rose by 7.9% in the 12 months to June 2023, down from 8.7% in May. (1)

On a monthly basis, CPI rose by 0.1% in June 2023, compared with a rise of 0.8% in June 2022.

Falling prices for motor fuel led to the largest downward contribution to the monthly change in CPIH and CPI annual rates, while food prices rose in June 2023 but by less than in June 2022,

also leading to an easing in the rates.

Harry Markowitz, father of modern portfolio theory, has died aged 95.

He was born on 24th August 1927. He was an American economist and Nobel laureate known for his pioneering work in the field of modern portfolio theory.

He was born in Chicago, Illinois, USA and grew up in a Jewish family. Markowitz developed an early interest in mathematics and economics, which laid the foundation for his ground-breaking contributions to the field of finance.

Markowitz earned his bachelor’s degree in economics from the City College of New York in 1947. He then moved to the University of Chicago, where he was exposed to the teachings of prominent economists, including Milton Friedman and Jacob Marschak, who greatly influenced his research interests.

In 1952, Markowitz published his seminal paper, “Portfolio Selection,” which introduced the concept of diversification and laid the groundwork for modern portfolio theory. His work demonstrated that investors could maximise their expected returns while minimising risk through the careful allocation of assets across different investments. This ground-breaking research revolutionised the field of investment management and formed the basis for modern portfolio management practices used by investors worldwide.

In recognition of his ground-breaking contributions, Harry Markowitz was awarded the Nobel Prize in Economic Sciences in 1990. His work not only transformed the way investors approach portfolio management but also had a significant impact on the broader field of financial economics.

His contributions continue to shape the world of finance and investment management, and his work remains highly influential to this day, including this edition of the market briefing and our smart diversification concept. His pioneering research on modern portfolio theory paved the way for advancements in risk management, asset allocation, and portfolio optimisation, making him one of the most influential figures in the field of finance and investing.

Markowitz was also reported to have said that “diversification is the only free lunch in investing”.

However, is diversification the only ‘free lunch’ in investing, or are there others?

Rebalancing: investing’s other “free lunch”

What is rebalancing?

“Rebalancing refers to the process of returning the values of a portfolio’s asset allocations to the levels defined by an investment plan. Those levels are intended to match an investor’s tolerance for risk and desire for reward.”

“Over time, asset allocations can change as market performance alters the values of the assets. Rebalancing involves periodically buying or selling the assets in a portfolio to regain and maintain that original, desired level of asset allocation.” (3)

Rebalancing a portfolio regularly has been advocated by financial professionals and supported by academic research.

Here are some key points and evidence that highlight the benefits of regular portfolio rebalancing.

Rebalancing helps to make sure that the portfolio remains aligned with an investor’s longterm financial goals and investment strategy. As goals or circumstances change, the target allocation may need to be adjusted.

Regularly rebalancing allows investors to reassess their asset allocation and make necessary changes to stay on track towards their objectives.

Why rebalance?

Buying undervalued assets

Rebalancing provides an opportunity to capture profits from investments that have performed well.

When certain assets have significantly appreciated in value, selling a portion of those assets during rebalancing allows investors to lock in the gains and potentially reinvest in other assets with better growth prospects.

Disciplined and unemotional

By sticking to a predetermined rebalancing schedule, investors can maintain a long-term perspective and avoid making impulsive investment choices meaning investors are less likely to make impulsive decisions driven by short-term market movements.

Aligning with investment goals

Rebalancing helps to make sure that the portfolio remains aligned with an investor’s long-term financial goals and investment strategy. As goals or circumstances change, the target allocation may need to be adjusted.

Regular rebalancing allows investors to reassess their asset allocation and make necessary changes to stay on track towards their objectives.

Avoid concentration risk

Without regular rebalancing, portfolios can become heavily concentrated in a few assets or asset classes that have experienced significant growth. This concentration can increase the vulnerability of the portfolio to downturns in those specific assets due to lack of optimal diversification.

By rebalancing, investors can make sure their portfolio remains diversified and reduce the potential negative impact of concentrated positions.

Maintaining risk

Over time, the performance of different assets within portfolio can cause the allocation to deviate from its original risk target and the investors’ risk tolerance. Some assets may outperform while others

underperform, leading to an unbalanced asset allocation.

Rebalancing prevents the portfolio from becoming overly exposed to a single asset or asset class, which could increase the overall risk.

Rebalancing helps to bring the portfolio back in line with the desired risk tolerance of the investor.

Risk reduction

As discussed, rebalancing helps maintain a desired risk level in a portfolio.

As the evidence shows below (under ‘What the evidence shows’), rebalanced portfolios maintain their risk tolerance.

Although not shown below, rebalanced portfolios also tend to have lower volatility and downside risk compared to portfolios that are not rebalanced.

By periodically realigning the asset allocation, investors can reduce the potential for extreme losses during market downturns.

What the evidence shows

Mathematical evidence supporting the effectiveness of rebalancing comes from a concept known as “portfolio drift.” Portfolio drift refers to the deviation of an investment portfolio’s asset allocation from its target allocation over time due to differential asset performance.

To illustrate the mathematical evidence, let’s consider an example with two assets, represented by world equities and global bonds, and assume an initial target allocation of 50% for each asset in a starting portfolio value of £100,000, i.e. £50,000 invested in each at the start.

Graph 1 shows the annual calendar returns of a blended portfolio starting with £50,000 invested into world equities, and £50,000

invested into global bonds, between 2013 and 2022 inclusive, i.e., a 10-year period.

By the end of 2022, this £100,000 portfolio, that has been allowed to drift without rebalancing, grew to £176,316.11 (as highlighted). This end amount was made up of £123,212.70 in equities (69.88% of the end amount) and £53,103.41 (30.12%) in bonds. This is a materially higher risk rating than the original portfolio at the start of 2013.

Graph 1 – Portfolio Drift annual calendar performance 2013 to 2022

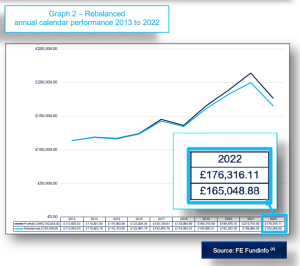

Graph 2 shows the actual annual calendar returns of the same blended portfolio but rebalanced annually. This means at the beginning of each year, 50% is allocated to world equities and 50% is allocated to fixed income. Thus, the risk rating is also rebalanced back correctly.

In this example, by the end of 2022, this £100,000 rebalanced portfolio, grew to £165,048.55 (as highlighted). This end amount was made up of £82,140.05 in equities (49.77% of the end amount) and £82,903.82 (50.23%) in bonds.

Graph 2 – Rebalanced annual calendar performance 2013 to 2022

So, why bother to rebalance?

By the end of 2022, the combined rebalanced portfolio had grown to £166,046.88, as compared with the drifted portfolio valued at £176,316.11. So the question that should be answered, is why bother rebalancing?

As Graph 2 shows, the actual returns in our example of the drifting portfolio over the last decade shows it returning around £11,000 more than the rebalanced portfolio. So, if the objective for rebalancing is for performance returns, then the evidence is dubious as to whether reducing the exposure to higher risk asset types, such as equities, via rebalancing, is of benefit. But this objective ignores the fact that if performance returns is an investor’s ultimate objective, then there is a whole raft of evidence that shows that all their investments should be wholly in equities; but investors don’t feel comfortable in doing that most of the time.

Why is that?

Generally, the reason is an investor’s emotional capacity to accept short-term, uncrystallised loss, a concept known as risk aversion. In a theoretical ideal world, all investors want stellar returns with no losses, but that’s not realistic. All investments can lose value periodically. As the famous regulatory wealth warning states, ‘unit prices and shares can fall as well as rise and you may not get back the full amount invested’; in other words, loss – and risk – is a necessary price to pay for investment returns. To mitigate investment loss, investing across different asset types – asset allocation – has been proven (by Harry Markowitz and others) to balance the need for returns whilst reducing the exposure to investment loss. Once an investor accepts this, rebalancing is imperative.

Why rebalancing is imperative?

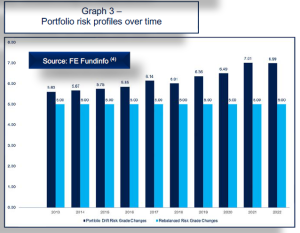

Graph 3 shows both the rebalanced portfolio (light blue) and the drift portfolio (dark blue). Rather than showing the returns (as shown in graph 2), graph 3 shows how the risk profile of each portfolio changes – or not – over the ten years being considered.

As discussed above, the drift portfolio provides a higher return, but this return comes with a detrimental consequence. And that consequence is that over the ten years the risk profile increases from a risk grade 5 (out of 10) to just under a risk grade 7; a material increase of nearly 40%.

Graph 3 – Portfolio risk profiles over time

On the other hand the rebalanced portfolio although delivering a lower return, over the ten years being considered, retains the risk profile at risk grade 5 (out of 10), helping investors with their capacity for investment loss.

What should this tell you?

As shown above, the evidence supporting superior returns for a rebalanced portfolio is ambiguous; research can be found that supports allowing a portfolio to drift, whilst opposing research supports rebalancing a portfolio regularly. So, the decision as to whether to rebalance or whether to allow a portfolio to drift ultimately depends on an investor’s attitude to risk and their psychological and practical ability to cope with investment loss. Although historical evidence supports that given time, most, if not all losses, will recover, the time period when the investment is ‘below water’ can be troubling for investors.

And it’s this psychological analysis and discussion that is ultimately the essential determining factor. If a long-term investor can cope with short to medium term losses – which can be substantial – then it’s likely that not only should they be invested in a portfolio that drifts, it’s also likely that they should be invested almost entirely in equities.

On the other hand, most investors, whether for some, or all of their invested capital, require some form of diversification to help cushion losses when they inevitably occur. The principles drawn from the above means that investors should likely be smarter and broader regarding their investment diversification. This could include a wide spread of geographical areas, asset types, styles, and philosophies, which are then rebalanced over time.

As we have said many times before, we will continue to monitor the current financial situation and keep you notified of any significant changes that are made. Please contact your Foster Denovo Partner if you wish to discuss your financial situation further.

At times like these, it is even more important that you are taking advice on your finances by a qualified and experienced financial planner. If you think any of your friends, family or colleagues would benefit from speaking to us, especially in the current situation, then please introduce them to your Foster Denovo Partner who would be happy to help.

Sources

- https://www.ons.gov.uk/economy/economicoutputandproductivity/output/articles/ukeconomylatest/2021-01 25#labourmarket

- https://www.investopedia.com/terms/r/rebalancing.asp

- https://www.bankofengland.co.uk/stress-testing/2023/bank of-england-stress-testing-acs-results-2022-23

- FE Fundinfo

Foster Denovo Private Wealth is a trading name of Foster Denovo Limited, which is authorised and regulated by the Financial Conduct Authority Registration No: 462728.

Registered office: Foster Denovo Limited, Ruxley House, 2 Hamm Moor Lane, Addlestone, Surrey, KT15 2SA.

Phone: 01932 870 720 Email: info@fosterdenovo.com Website: www.fosterdenovo.com | PWMB54280723

0330 332 7866

0330 332 7866 advise-me@fosterdenovo.com

advise-me@fosterdenovo.com Search

Search