The roles of asset allocation and diversification in your investment portfolio

26.03.2024If financial markets have taught anything over the past few years, it’s that global unrest can result in significant short-term market volatility.

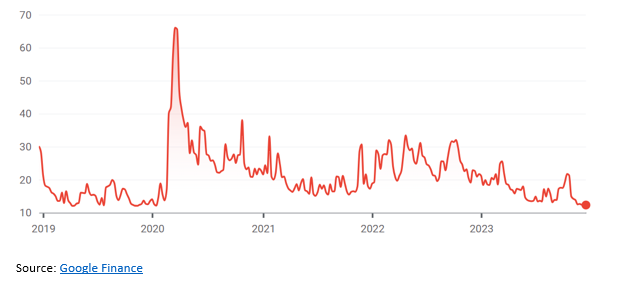

The Covid pandemic, Russia’s invasion of Ukraine, and the cost of living crisis, have all helped to create dramatic spikes and troughs on the CBOE Volatility Index, as seen below:

Thankfully, there are ways to manage risk in your investment, through asset allocation and diversification.

Keep reading to discover more, and to find out how Foster Denovo can help you clear a path to your long-term goals and achieve much-needed peace of mind.

Asset allocation is the combination of asset classes you invest in

Asset allocation is the way we divide your investments between different types of assets, like cash, bonds, shares, and property.

Individual asset classes carry different levels of risk so it’s important to understand how much risk you are willing to take. Greater risk carries the potential for greater rewards, but larger losses too. It’s vital that your asset allocation aligns with your risk profile, and that your allocation is revisited if changes in performance throw your weighting out of line.

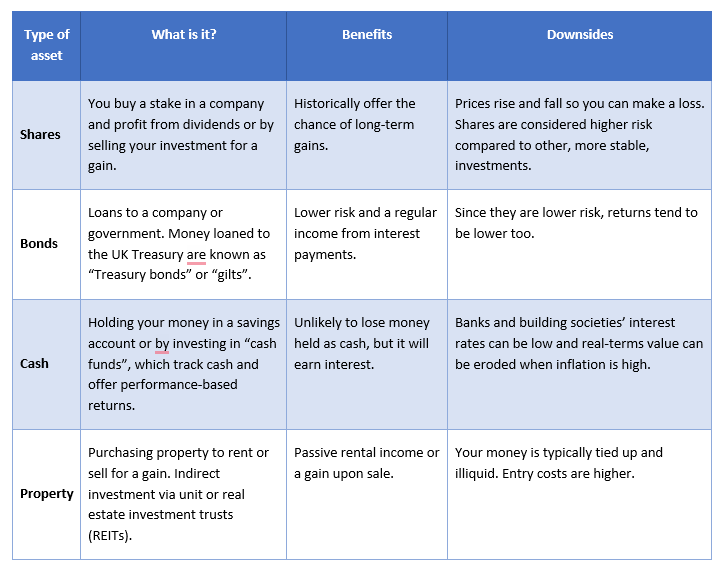

There are four “main” asset types. The table below shows the principal benefits and downsides of each:

Investment portfolios typically spread risk through investing in a range of assets, but the “right” allocation for you will depend on your:

- Long-term goals

- Attitude to risk

- Investment term.

Remember, your asset allocation will be regularly reviewed to ensure it still aligns with your profile but changes to your circumstances or priorities could also mean a reallocation is needed. Be sure to get in touch if you think this might be the case.

Investing in several asset classes to spread risk is called “diversification”

As we have seen, you can diversify your portfolio by managing your asset allocation, effectively spreading the risk. Different asset allocation will carry more or less risk and this can then be aligned to your individual profile.

It is also possible to diversify within asset classes. For instance, if you invest in stocks and shares, you can spread your investments across companies in different sectors, industries, and geographical locations.

Diversification here helps to further spread risk. It is hoped that any losses that occur in a particular asset class, sector, or region will be offset by rises elsewhere in your portfolio.

The following asset quilt shows the performance of eight diverse funds between 2012 and November 2023, illustrating the power of diversification:

Source: JP Morgan

As you can see, predicting which funds would outperform the others in a particular year isn’t easy. While we have decades of market experience at Foster Denovo, we also understand the importance of spreading risk.

Trend chasing and other emotional biases can adversely affect the portfolio values of inexperienced investors. But, managing risk across a diversified portfolio, gives you the best chance of achieving your long-term goals.

Foster Denovo can help you allocate your assets and diversify your portfolio

If you’re still unsure about the best way to divide your assets, then Foster Denovo is on hand to assist. We can help you:

- Discover your risk tolerance

- Build a balanced portfolio

- Focus on your long-term goals

- Conduct regular reviews.

We have decades of experience and are experts at delivering positive outcomes for our clients, offering a range of dynamic portfolios incorporating both active and passive management.

We can ensure that your asset allocation is always the optimal one for you, giving you confidence and peace of mind that your wealth is organised and that you are on track to reach your goals.

Please email us at advise-me@fosterdonovo.com or call 0330 332 7866 for more information. Book a meeting.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Sources: https://www.google.com/finance/quote/VIX:INDEXCBOE and https://am.jpmorgan.com/gb/en/asset-management/adv/insights/market-insights/market-updates/monthly-market-review/

Search

Search