The new tax year 2020/2021

7.04.2020In most years the beginning of April marks a welcome opportunity for us to spend time with family, celebrate Easter, enjoy the coming of Spring, and review our financial plans for the beginning of the new tax year.

This year, due to the effects of COVID-19, many of us have already been surrounded by family for the past couple of weeks while working from home or dealing with school closures. Socially, this has been a very stressful and unusual time, marked by shifting priorities, during which financial planning may well have taken a temporary back seat.

Financially we find ourselves in somewhat uncharted territory, which makes it even more important that we use this time indoors to prepare ourselves for the 2020/2021 tax year. By thinking about using our annually renewed tax allowances early in the tax year, we not only put ourselves in a better position to enjoy a summer with some of the coronavirus restrictions lifted but also make sure that we do not miss out on any tax allowances as the year progresses.

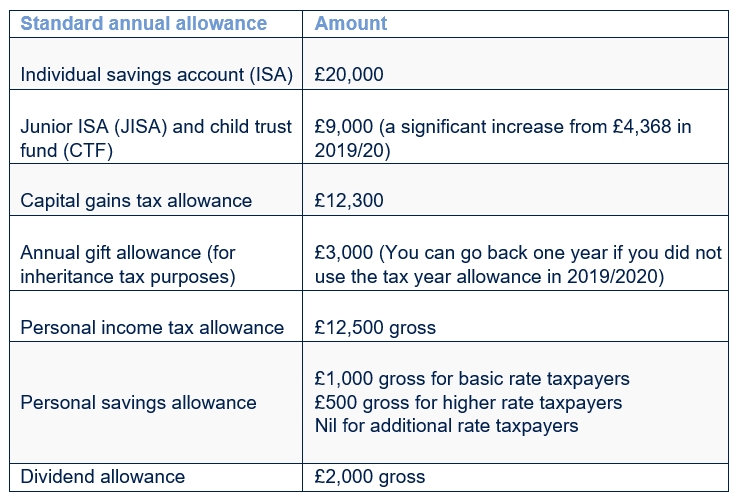

The government has been rushing through various additions and amendments to the Budget, both to deal with the crisis and also in more general terms. For many of us, our financial planning for 2020/21 will begin with us looking at how we can best make use of the following allowances:

There have been some significant alterations to tax allowances, including to the tapered annual allowance for pension contributions, which may be particularly impactful for higher earners. The threshold at which tapering starts has been raised by £90,000, meaning that from this new tax year the ‘adjusted income’ will increase from £150,000 to £240,000. ‘Threshold income’ will also increase notably from £110,000 to £200,000. For those on the highest incomes, the standard annual allowance of £40,000 from all sources will taper down.

The annual allowance for pension contributions is £40,000. But the taper comes into play for higher earners or high-income individuals who are defined as those with an ‘adjusted income’ of over £240,000 (previously £150,000) for the tax year, and threshold income of over £200,000 (previously £110,000).

Under the Budget changes, for those on the very highest incomes, the minimum level to which the annual allowance can taper down will reduce from £10,000 to £4,000 from April 2020. This reduction will only affect individuals with total income (including pension accrual) over £300,000. These alterations may provide higher earners with a beneficial opportunity to fund their pensions. This will be subject to their overall lifetime allowance (LTA) for pension benefits, which is the maximum that someone can accrue in registered pension schemes in a tax-efficient manner during their lifetime. This allowance has also changed for the new tax year, with an increase up to £1,073,100, in line with CPI.

If you would like to discuss how to maximise your allowances or if you have any queries on how the changes may affect you, please contact us.

The value of your investment can go down as well as up and you may not get back the full amount invested.

0330 332 7866

0330 332 7866 advise-me@fosterdenovo.com

advise-me@fosterdenovo.com Search

Search